I recently completed a five-week programme called your POWER TOOLKIT with Victoria Turner. Each week we filled out a worksheet with our two focus goals for the next twelve months, our bold action for the week, our weekly priorities that would help us achieve those goals, and how the tools that we’d learned in the programme would help us meet them. If you are a recent grad, she’s offering this programme again starting on May 24 and I highly recommend you enroll.

This week I received FANTASTIC NEWS from three of my clients. One of them gave her notice and is going to be joining an independent law firm after taking six weeks rest over the summer. It comes with a salary cut (that’s not insignificant) and some added risks and costs, but she’s so happy about it. Another client is moving up her timeline to purchase her first condo after seeing how much her savings had grown in the last year. A third has been offered a full-time role with benefits and would like to increase her kids’ savings and buy a new house next year; this after she left her husband and an unfulfilling work situation a couple of years ago. I am so incredibly happy for all of them. I didn’t realize it until I did the POWER Toolkit programme that they are where they are because they had a focus goal!

The first one paid off her student debt, started an aggressive savings plan, and purchased disability insurance so that she could have the freedom to make the best career choice based on her life, not her financial need. Since we started working together she has paid off the rest of her law school debt, has made great progress for her savings and is now pursuing the next opportunity in her life knowing that she’s protected from both a savings and insurance perspective. It meant more trips on her bike, a few less dinners out, brown-bagging her lunch, but it was her goal and now she’s achieved it! Having been in her situation a few years ago, I know the reward and relief she’s feeling and I’m so incredibly happy to have been part of it!

The second one increased her savings and kept to a budget. Her focus goal was having a dishwasher, and every few months with that goal in mind, she increased her savings, or made lump-sum deposits knowing that the sacrifices were helping her to get her dishwasher. When we would meet that dishwasher was what we’d talk about and how to get it for her. The dishwasher represented more than the simple appliance, but it was an image that she could focus on to help her stay disciplined to the plan we put in place. I can’t wait to see her dishwasher in her new condo!

The third one set up her kids’ education plans, her own savings plans, and her own health and dental insurance after finding herself in two situations she needed to leave. She had a goal to start her own travel business, which had to be set aside when her ex-husband wasn’t paying his support at the end of last year. With two children, including one with a disability, their future and stability was her focus goal. Despite the costs for the programmes her one child needs, she managed to make it through when the support stopped by taking on a contract role, and personal discipline. She kept contributing to the children’s savings plan, and providing them with the stability they needed. We talked about her risk tolerance and savings throughout. It turned out she loved the company she got the contract with and has now been offered a fulltime role with them with benefits. Her ex-husband paid back some of the support, and she’s focused on increasing her kids’ savings and her own savings. Her kids and her future were her focus goals and I’m so happy to see her on her feet with many amazing things coming to her!

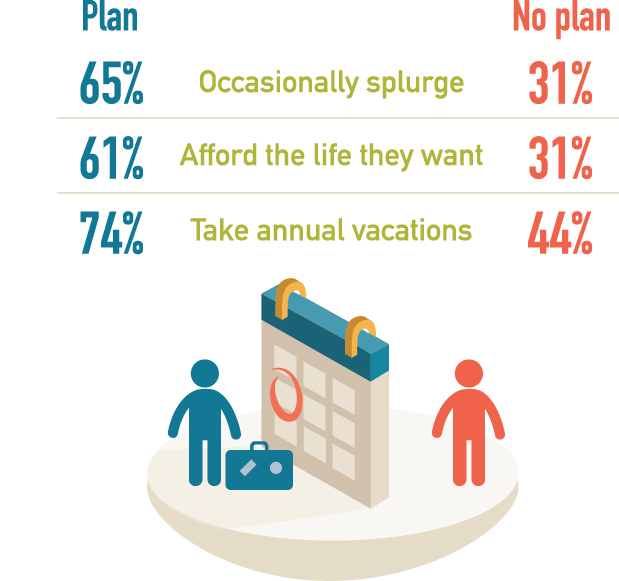

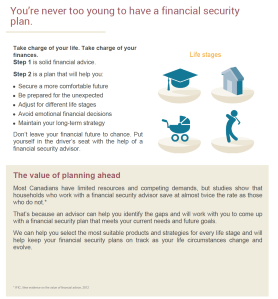

Having a focus goal helps us stay committed to our plans; including our financial plans. Whether it’s our family’s security, investing in ourselves, a major purchase, or work/life flexibility, setting up a financial plan helps you to focus on the goal and provides the discipline of savings, insurance, and investing, to help you meet it. Consistent and early savings plays more of a role in long-term financial security than the individual investments that you choose. Purchasing insurance early gives you better rates for life and the security of knowing you can protect yourself and your family to help you meet your goals. I am genuinely and completely happy for these three clients for meeting their focus goals! Keep your eye on the prize and you’ll be rewarded!